NSB INVESTORS 19

Hard & Private Money, Trust Deed, Cannabis Real Estate Financing

COMMERCIAL R.E. SYNDICATION AND ACQUISITION

Please read the FAQs below carefully and familiarize yourself with our lending policies. If you think you and your project meet our lending requirements, we'd be happy to discuss and review the deal with you.

Hopefully all the questions you may have are answered below. If you have any additional questions, please feel free to contact us.

LOAN QUESTIONS:

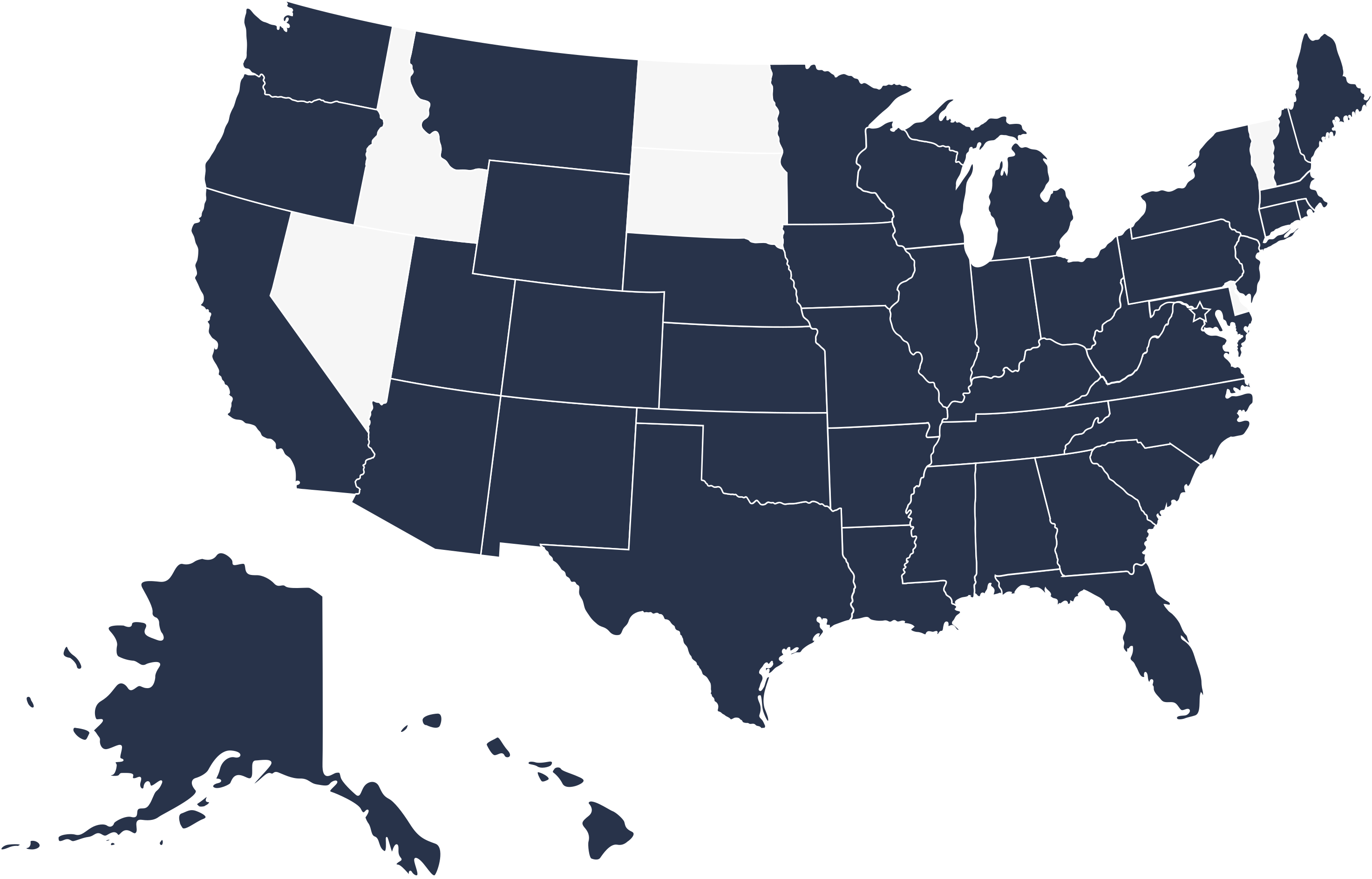

Q: What states do you lend in and what type of properties do you lend to?

A: We lend nationwide to commercial, residential, non-owner occupied properties in A, B, and C class areas. We do not lend to properties in undesirable/war zone areas.

Q: What loan products do you specialize in?

A: We specialize in providing short-term/bridge financing (12-24 months) to real estate investors, flippers and rehabbers who are able to purchase non-owner occupied, residential properties at a 30%-50% discount. Properties such as foreclosures, REOs, Short Sales, Owner Direct, etc. The property gets rehabbed then re-sold within 6-12 months for a profit.

Q: How do you handle rehab funds?

A: Rehab funds are escrowed and managed by draws. Draws are released AFTER a milestone has been verified complete by one of our certified 3rd party builder's control company. Once the work scheduled for Draw #1 is verified complete, we then release the draw. In addition, we require rehab funds to first go towards buying material, and whatever is left over can be applied to labor cost.

Q: How do you structure your loans?

A: We offer non-amortized, interest-only balloon loans that mature within 12-24 months.

Q: Do you demand prepayment penalties?

A: Typically we don't, however sometimes depending on the complexity of the loan and the amount of time and effort we spend underwriting the loan we may.

Q: Can the borrower be a Corporation or LLC and hold title in the entity?

A: Yes. In fact, we prefer lending to domestic single-purpose business entities such as a LLC or Corporation. As part of the due diligence process, we must review the governing Company by-laws or operating agreement and verify the individual(s) are authorized to sign documents on behalf of the entity.

Q: Do you lend to owner occupied properties?

A: Never. However we may have conditions set to be able to lend to owner occupied but prefer to lend to non-owner occupied.

Q: Will you take a 2nd lien position on a loan?

A: Rarely. For us to consider a 2nd position loan, the LTV must be significantly low. In addition, we must carefully review the terms of the 1st position loan to see if it fits our criteria. 2nd position loans are riskier loans resulting in a higher loan cost to the borrower.

Q: Do you offer new construction financing?

A: Yes. A commercial investor/rehabber can use our private loan as a lending tool for financing when he/she only plans on holding the investment property until the construction or rehab work has been completed and the property goes to sale.

Q: Do you determine the value of the property solely by using an appraisal?

A: Yes. We determine the value of the property via an appraisal that is ordered by us and paid by the prospective borrower. We never use the borrower's appraisal.

Q: Do you have the property inspected before making a decision on whether to lend on it or not?

A: Rarely. We may choose to hire a certified 203K inspector to do a feasibility study on the property in order to have a more in-depth review of both the proposed work and the rehab budget to ensure all necessary items of work have been addressed in the scope of work and proposed budget.

Q: Are you a direct lender?

A: Yes we are. We are NOT a broker. There is no middle-man involved. We write the checks. We use our own cash to fund deals and if our resources happen to be tied up in other deals, we have money partners who we team up with to help fund your deal.

Q: How soon can you fund my deal?

A: Usually within 7-10 business days AFTER all the required documentation is provided by the prospective borrower and all due diligence is completed by us. Obviously, the longer the prospective borrower takes to submit the required documents, the longer it would take to close. We expect professionalism and expediency from everyone we work with therefore we expect prospective borrowers to have ready the required documents on day #1 of them contacting us. Doing so shows us the borrower is serious and passionate about their business.

Q: How soon does it take to get a pre-qualified?

A: Usually within 24-48 hours after the requested information is submitted by the prospective borrower.

Q: Do you only lend to experienced professional investors/flippers?

A: Typically yes. We prefer dealing with seasoned professional investors/flippers because they usually have the experience and resources (cash for skin in the project) we require in order to fund their deals. Rookie investors/flippers pose a higher risk for us due to their lack of experience plus they tend not to have the required down payment deposit and therefore require 100% financing of the entire project cost which we nor any lender would ever do.

COST & REQUIREMENTS:

Q: What are your fees?

A: It all depends on the individual deal but in general terms, we charge anywhere between 6.5%-9.5% per annum and 2-4 origination points depending on the size, length, loan position, and complexity of the loan. Our rates and terms also depend on the State we are lending in. We also charge standard underwriting fees when vetting prospective borrowers such as credit checks and criminal background reports. Once we commit to funding your deal we require a minimum Earnest Money Deposit to cover the cost of our attorney drafting up the closing docs. There are cost that are accumulated before closing that the borrower will be required to pay.

Q: Will you roll loan costs into the loan?

A: Depends how good the deal is. If the deal has a low LTV such as a 50% LTV or lower, then we may be able to roll some of the loan cost into the loan.

Q: Do you require the borrower to have reserves (cash) for “skin in the game”?

A: Absolutely. In order to ensure that our borrowers are committed to the project, we require all borrowers to have "skin in the deal". In other words, the borrower must have their own cash into the deal in the form of a down payment. The borrower must be willing to put in a nominal down payment that gets deposited into escrow or Lender's attorney. The typical down payment is around 10%-20% of the loan amount + loan cost amount.

IMPORTANT: We do not finance projects where there is no "skin in the deal" from the borrower.

Q: What if I don't have the required 10%-20% down payment funds?

A: If you do not have the required cash for the down payment, then we will accept another free & clear investment property or properties you own as collateral. You may also bring in a co-borrower who may have the required cash for the down payment. In addition to such situations where the borrower is unable to come up with sufficient cash contribution, we may require a 50/50 profit share loan structure to compensate us for the added risk we would be taking on from the borrower not having enough skin in the deal.

Q: What is the minimum credit score you require for a loan?

A: No credit score is required, however, we do examine the borrower’s credit and look for any judgments, bankruptcy, payment patterns, especially mortgage and auto payments.

Q: Is there a minimum credit score you require if the exit strategy is to refinance with a traditional bank?

A: Yes. We require a minimum FICO credit score of 650+ if your plan is to refinance with a bank to pay us off.

Q: What income requirements do you require?

A: We do not require any income requirements for the borrower, however at minimum, the borrower must be able to demonstrate via bank statements, the ability and resources to pay the loan origination points, the scheduled interest payments and other carrying cost associated with the loan.

Q: Do you require the borrower to personally guarantee the loan?

A: Yes we do. As mentioned earlier, we only lend to business entities. And therefore require a personal guarantee from the members/shareholders of the entity.

Q: What debt coverage ratio do you require for income producing properties?

A: We require a minimum 1.2 debt coverage ratio.

Q: What documents do you require from a prospective borrower to consider funding a loan?

A: The qualifying documents are:

ENTITY DOCUMENTS:

- Articles of Incorporation

- LLC Operating Agreement or Corporation Bylaws

- Entity’s last (4) bank statements for all open accounts (all pages)

- LLC Tax statements

MEMBER/SHAREHOLDER DOCUMENTS:

- Member/Shareholder's last four (4) bank statements for all open personal accounts (all pages)

- Member/Shareholder's valid State photo I.D./Driver’s License

- Member/Shareholder's loan application: Fully completed and signed

PURCHASE LOANS:

- Purchase contract and any extensions, if any (signed by both parties)

REFINANCE LOANS:

- Copy of deed/title of property and copy of all notes against the property

REHAB LOANS:

- Detailed line item scope of work budget

- Draw schedule

- Contractor’s license, certificate of liability insurance, worker’s comp insurance and bond number

FREQUENTLY ASKED QUESTIONS